How a Tier 1 bank found the real cause of a 19-point NPS crash in minutes

In this case study, you’ll see how a Tier 1 bank with a global footprint used Ipiphany to understand a sharp NPS drop in its online banking channel.

You’ll learn how the insights team:

- Analysed thousands of NPS comments in a single view instead of sampling

- Used topic tracking to see which themes drove the score down

- Isolated a browser-specific issue that customers were still experiencing

- Turned unstructured feedback into a clear story for leadership

Proven by the World’s Top Brands

.png?width=2000&name=Gemini_Generated_Image_fwyw5vfwyw5vfwyw%20(1).png)

From raw NPS comments to a clear root-cause story

Ipiphany’s AI feedback analytics platform sits under every case study we deliver.

Continuous analysis across all channels

Root-cause analysis made simple

Stakeholder-ready reporting

Built for banks and enterprises

We scale with your feedback program

Early VoC programs

Prove the value of NPS comments to the business

Share quick wins with Digital, Product and CX teams

Scaling digital channels

Compare NPS drivers across app, web and contact centre

Prioritise fixes by impact on score and customer volume

Spot issues early with trends over time

Enterprise-wide CX

Standardise how you read and report on comments

Give insights teams a single source of truth

Support leadership with consistent, data-driven stories

What digital leaders say about Ipiphany

Group Account Director, CX

Research Sector

"Ipiphany has transformed the way we work. The time we spend coding verbatims has reduced from five days to just a few hours, after a simple two-hour setup. Our analysis capability has grown tenfold - the team now focuses on drawing meaningful insights and building strong hypotheses, rather than just reporting surface-level connections..."

Financial Services Sector

Customer Insights Manager

"Ipiphany ensures we’re guided by customer voice - not just internal narratives - helping us decide where to allocate resources for the greatest customer impact."

Digital Business Banking Director - Barclays Bank, UK

Adrian S

"If you need to analyse, organise and understand key themes from unstructured customer comments, as well as the degree of impact they have on key metrics you are surveying on, then this is the tool you need."

Managing Director - Resilient IT, NZ

Simon J

"It is refreshing to see such a commitment to information security and privacy reflected within systems, technology and culture at Touchpoint Group."

Financial Services Sector

Customer Insights Manager

"In over 20 years of working with text analytics platforms ... Ipiphany stands out as one of the best. It delivers rich, nuanced insights at speed, reducing time-to-insight from weeks to days. Its root cause detection helps us solve the real problems, while impact-based prioritisation shows which issues affect CX and NPS the most. With flexible reporting and a user-friendly interface."

Head of Marketing - Tortilla, UK

Megan B

"Ipiphany enabled us to read tens of thousands of lines of unstructured text from our third party delivery company quickly and efficiently. Providing us with an overview of areas we can improve our customer experience and B2B relationship."

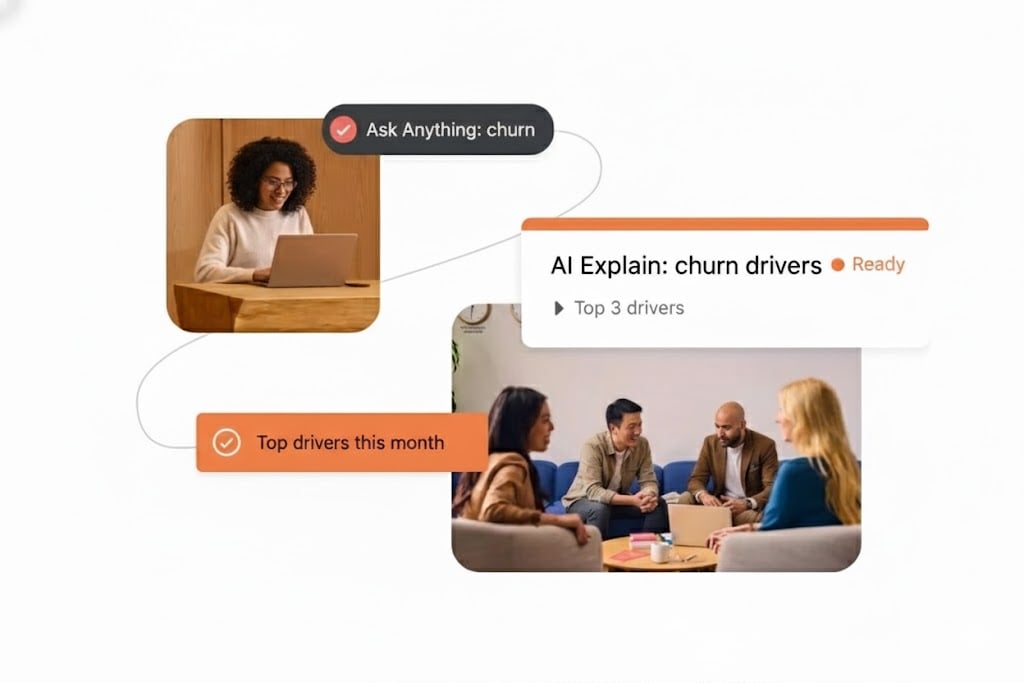

Why banks choose Ipiphany for NPS analysis

Faster answers

From weeks of manual reading to hours of AI-driven analysis. Ideal when you need answers before a board or CEO review.

Clear focus

See which topics matter most to your customers and to NPS, instead of guessing or debating opinions.

Ongoing improvement

Use painpoint and highlight dashboards to track progress, monitor known issues and spot new risks early.

Get the Tier 1 bank NPS case study

See the exact steps this bank took to find the root cause of a 19-point NPS drop and build an ongoing improvement loop using Ipiphany.

“Ipiphany keeps us customer-led, not assumption-led.” - Senior Insights Leader, Banking Sector